Understanding Debtor Days: The Essential Formula for Managing Accounts Receivable

In the world of finance and business management, debtor days formula effective cash flow management is crucial for sustainability and growth. One key metric that helps businesses assess their effectiveness in managing accounts receivable is the “Debtor Days” formula. This metric provides insights into how quickly a company collects payments from its customers, enabling better financial planning and decision-making. In this article, we will delve into the concept of Debtor Days, how to calculate it, its significance, and strategies for improving this metric.

What Are Debtor Days?

Debtor Days, also known as Days Sales Outstanding (DSO), is a financial metric that indicates the average number of days it takes for a company to collect payments from its customers after a sale has been made. A lower number of debtor days signifies a quicker collection process, which is generally favorable for a company’s cash flow. Conversely, a higher number indicates delays in payment, which can pose challenges for cash flow management.

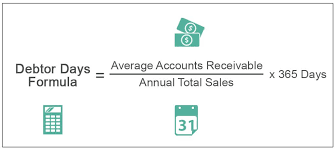

The Formula for Calculating Debtor Days

The formula for calculating Debtor Days is relatively straightforward:

Debtor Days=(Accounts Receivable Total Credit Sales)×Days\text{Debtor Days} = \left( \frac{\text{Accounts Receivable}}{\text{Total Credit Sales}} \right) \times \text{Days}Debtor Days=(Total Credit Sales Accounts Receivable)×Days

- Accounts Receivable (AR): This is the total amount of money owed to the company by customers for goods or services delivered but not yet paid for.

- Total Credit Sales: This represents the total sales made on credit during a specific period (usually a year).

- Days: Typically, this is set to 365 days to reflect a full year, but it can also be adjusted for shorter periods (like 90 days for quarterly analysis).

Assumptions:

- Accounts Receivable: $50,000

- Total Credit Sales for the year: $600,000

Calculation:

-

Calculate the ratio of Accounts Receivable to Total Credit Sales:

Accounts ReceivableTotal Credit Sales=50,000600,000=0.0833\frac{\text{Accounts Receivable}}{\text{Total Credit Sales}} = \frac{50,000}{600,000} = 0.0833Total Credit SalesAccounts Receivable=600,00050,000=0.0833

-

Multiply by 365 days:

Debtor Days=0.0833×365=30.42\text{Debtor Days} = 0.0833 \times 365 = 30.42Debtor Days=0.0833×365=30.42

In this example, the company takes approximately 30.42 days to collect payment from its customers on average.

Significance of Debtor Days

Understanding Debtor Days is crucial for several reasons:

-

Cash Flow Management

Effective cash flow is vital for any business. A lower debtor days value indicates that a company is able to convert sales into cash quickly, which can be reinvested in operations, used to pay down debts, or distributed to shareholders. A longer collection period can lead to cash flow shortages, making it difficult to meet operational expenses.

-

Credit Policy Evaluation

Debtor Days can help businesses evaluate the effectiveness of their credit policies. If debtor days are increasing, it might indicate that the company is extending credit terms too liberally or that its customers are experiencing financial difficulties. Monitoring this metric can prompt a reassessment of credit policies and customer payment terms.

-

Benchmarking Performance

Businesses can compare their debtor days against industry averages or direct competitors. This benchmarking can reveal insights about operational efficiency and competitiveness. If a company has significantly higher debtor days than industry peers, it may need to take action to improve collections.

-

Financial Health Indicator

Investors and financial analysts often look at debtor days as an indicator of a company’s financial health. Consistently high debtor days may raise red flags, leading to concerns about the company’s ability to manage its cash flow and customer relationships effectively.

-

Strategic Planning

Understanding debtor days helps management in strategic planning. By projecting future cash flows based on current debtor days, businesses can make informed decisions about investments, expenses, and growth strategies.

Factors Influencing Debtor Days

Several factors can influence the debtor days metric, and understanding these can help businesses make informed decisions:

-

Customer Creditworthiness

The creditworthiness of customers directly impacts debtor days. If a company extends credit to customers with poor credit histories, it may face delays in payment.

-

Industry Norms

Different industries have varying norms for payment terms. For example, construction companies may have longer debtor days due to project timelines and payment schedules, while retail businesses typically have shorter cycles.

-

Economic Conditions

Economic conditions can also impact debtor days. In times of economic downturn, customers may delay payments, leading to increased debtor days.

-

Billing Practices

Efficient billing practices can help reduce debtor days. Companies that send out invoices promptly and follow up on overdue payments are likely to collect faster than those with inconsistent billing processes.

-

Sales Terms

The terms offered to customers—such as discounts for early payment or penalties for late payments—can influence how quickly payments are made.

Strategies to Improve Debtor Days

Improving debtor days is crucial for enhancing cash flow and overall business health. Here are several strategies to consider:

-

Review Credit Policies

Regularly review and adjust credit policies based on customer creditworthiness and payment histories. Implementing stricter credit checks for new customers can help mitigate the risk of non-payment.

-

Streamline Invoicing Processes

Clear and detailed invoices can minimize disputes and delays in payment.

-

Implement Payment Incentives

Offering discounts for early payments or incentives for customers who pay promptly can encourage quicker collections.

-

Enhance Customer Communication

Following up on invoices with reminders can prompt quicker payments.

-

Automate Collections

Consider utilizing technology and software solutions for accounts receivable management. Automated reminders, invoicing, and payment processing can streamline the collections process and reduce administrative burdens.

-

Assess Customer Relationships

Evaluate the quality of customer relationships. Long-standing customers may be more inclined to prioritize payments, while new customers might need more nurturing. Understanding customer dynamics can help tailor approaches for collection.

-

Set Clear Payment Terms

Clearly outline payment terms at the outset of the relationship. Ensuring that customers understand their obligations from the beginning can help reduce confusion and delays.

Monitoring Debtor Days Over Time

To effectively manage debtor days, businesses should not only calculate this metric regularly but also monitor it over time. Tracking changes can reveal patterns and help identify when issues arise. Regular reporting—monthly or quarterly—can assist in recognizing trends and making timely adjustments to credit policies and collections practices.

Limitations of the Debtor Days Metric

While debtor days is a valuable metric, it does come with limitations:

-

Variability Across Industries

Different industries may have vastly different averages for debtor days, making cross-industry comparisons less meaningful. It’s essential to benchmark against relevant competitors or industry standards.

-

Influence of Seasonal Sales

In businesses with significant seasonal sales fluctuations, debtor days can be skewed during peak periods. A temporary spike in sales may lead to artificially low debtor days, masking underlying issues.

-

One-Dimensional Perspective

Debtor days is just one measure of financial health. Sole reliance on this metric can overlook other crucial factors affecting cash flow, such as inventory turnover or operational efficiency.

-

Changes in Customer Base

A rapidly changing customer base can affect the reliability of debtor days. New customers may not have established payment patterns, making predictions difficult.

Also Read : Worldle: A Geography-Based Puzzle Game

Conclusion

In an increasingly competitive business landscape, effective cash flow management is paramount. The Debtor Days formula serves as a critical tool for businesses to evaluate their accounts receivable processes and overall financial health. By understanding how to calculate, interpret, and manage debtor days, companies can make informed decisions that enhance cash flow, improve customer relationships, and ultimately drive profitability.

By continuously monitoring and adapting strategies related to debtor days, businesses can not only optimize their collections process but also position themselves for sustainable growth and success in the long term. As financial landscapes evolve, maintaining a sharp focus on debtor days will empower organizations to navigate challenges effectively and capitalize on opportunities.